Meritocracy: A complete definition by Mr.Bernanke

Strateji, İş Geliştirme, M&A, Yönetim

Source: Jefferies Research

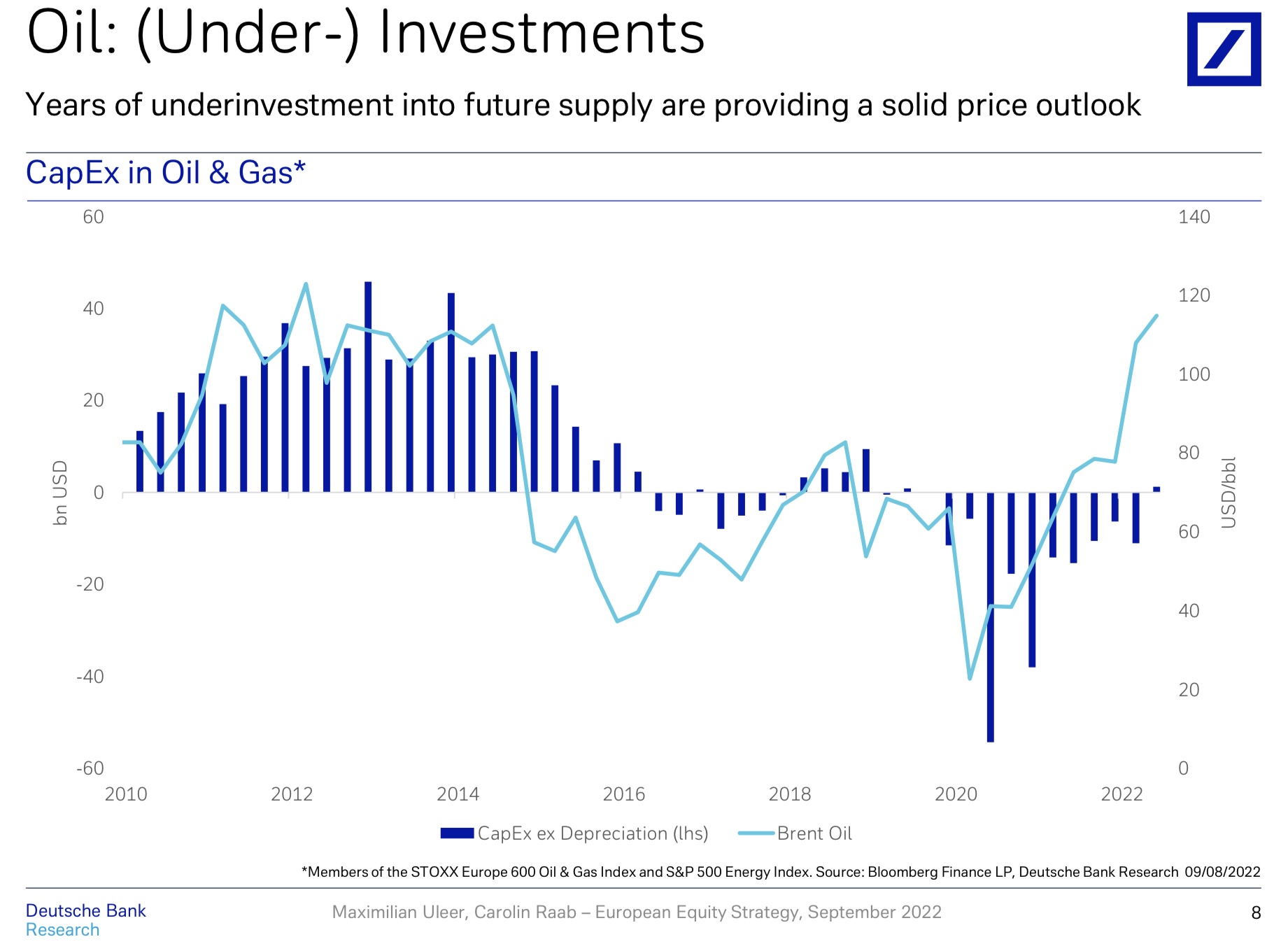

Petrol fiyatları daha uzun yıllar bu seviyelerde kalabilir…

I read Jamie Dimon (CEO of JPMorgan) emphasizing the benefits of organic growth at the expense of M&A:

“ Companies talk about acquisitions like that is what is going to save them. It’s not. What is going to save us is organic growth. Better products, better services, better bankers, better technology, hiring and training better people. Organic growth is harder and better than acquisitions. Most companies don’t do it because growing a sales force is hard. Opening branches is hard. Most people come up with a million reasons why they don’t do it.”

Hope investment banking division of JP and their clients will not hear this : ))

My view: When it comes to shareholder value creation, organic growth is a great way to deliver provide that the return marginal sales is high compared to the cost of marginal capital needed to fund the growth. However, bolt-on acquisitions also do create great deal of value if the targeting, valuation, transaction and integration is executed in the right way.

Instance? Look at the deals #Sika and #SaintGobain has been closing each year.

#Digital advertising market is going through a serious change for the last couple of years. State-level privacy laws in the US and platform privacy policy decisions (ATT of #Apple for instance) those have propelled are changing the ownership of the data available in the web and platforms and the ways it could be deployed by the platforms and advertisers.

Once having their utmost privilege to the abundant “first-party” user data and freedom to process these to create a well-crafted audiance “profiles” for the advertisers, platform companies such as Facebook and Google are trying to turn their apps into content and app distribution portals. AMP (Google) and Instant Articles (Facebook) are the recent examples of this trend. That is happening because “hub-and-spoke” model* of digital advertising (summarized at the end of this article) is not working well anymore.

And that is the primary reason behind recent collapse of #Meta share price as its first-party data (your likes, comments and inputs into the groups) is not much helpful for #targeting as your purchases in a mobile game or on the web.

So what is the next?

Many companies (advertisers) are developing their own proprietary ad network. Yes, that is.

Reason being that will allow them to #monetize their own data (and #Apple is among them).

Just to provide a couple of instances:

> Walmart is expanding its ad business through M&A

> Following UberEats, Doordash launched an ad platform.

> Zoom is introducing ads to its for free users

> Ironsource acquired an ad network Tapjoy…

So dear investors, get ready to see “Ad Network” lines in the 10-Ks of listed companies soon.

And sorry for those large platforms, those good old days seems to be too far away to make a good comeback. They, certainly, will try to adapt to the new circumstances.

*The model was based on operating a data warehouse full of usage “signals”, converting those signals into #targeting parameters, applying those to the ad inventory and creating positive feedback loop for the advertisers through engagement data.

Quality of the asset is of significance when it comes to #valueinvesting. Under a cloudy sky, it is even more so. #SBUX is one of those names in consumer universe that I feel the need to follow closely.

What makes #SBUX a quality asset?

The question that should be asked in the boards of all consumer/restaurant players around the world I believe.

A couple of elements relevant to #SBUX through my lens:

> Managing expectations of its own people well. “Because if we want to exceed the expectations of the customers, we have to exceed the expectations of our people” (Schulz explaining further increases in wages beign “ahead of the curve” at discussion of F2Q22 results)

> Ensuring customer continuity. Hugely successful Rewards programme which currently has 27.4Mn members in the US! By F3Q22, the spend by rewards members is at record levels. %58 of revenues come from Rewards members which showes huge #brandloyalty, which is challenging to create in restaurants/ food retail universe. What I like (for cash flow yield) in the Members program is the following: Customers #prepaid $11Bn of their purchases in 2021!

> Cash-on-cash returns (what a shareholder could like to see more?). It is around 70% at F3Q22. ROIC being 101%.

Going through F3Q22 numbers, one should note that US SSS of 9% is not a great performance compared to its universe where +15% is average topline growth in the same quarter. However, I liked the shift to cold beverages (75% of the beverages) which is difficult to replicate at home and higher partner engagement scores which has a track record of converging into SSS.

Her birey kendisini gündelik hayatın haksızlıklarının üzerine çıkarmalı, ancak bu sayede ‘kaderin cilveleri’ ile iyilik arasındaki çelişkiyi aşarak, nihai ‘İyi’ ile birleşebilir.

Benim için geçen haftanın kitabı olan, Ortaçağ Avrupa’sında en çok okunan kitapların başında gelen “Felsefenin Avuntusu Üzerine” eserinden aklımda kalan, bu önerme oldu.

Kitabın yazarı, imparatorluğun çöküşünü takiben, Ostrogot Theodorich’in hüküm sürdüğü, yaşlı ve bakımsız Roma’da sarayın himayesinde felsefe çalışan, Aristo’nun mantıkla ilgili tüm kitaplarını Latince’ye çeviren Boethius’tur.

Theodorich’e ihanet ile suçlanan Boethius’un, idamını beklerken hapishanede yazdığı “Felsefenin Avuntusu Üzerine”, Dante’ye -kendi ifadesine göre- sevgilisi Beatrice’nin ölümünün ardından tahammül kazandıracaktı.

Boethius’un bu savı, akla Augustinus’un (ve esasında onu esinleyen Plotinus’un) iyi “idea”sını ve onun ancak sevgi aracılığıyla bulunabileceği önermesini getiriyor.

Her şey zıddı ile mevcut ise, bu kısa notu, Uruguay’ın bilge adamı (eski devlet başkanı) Jose “Pepe” Mujica’nın sözü ile bitirmek ilginç olabilir: “Bazen iyi olan kötüdür, kötü olan ise bazen iyiye yol açar”

Liners, ship and port owners are having a great party since mid-2021. Seems that the party shall continue in 2H22. Below are the drivers that make me think that way:

* Key indicators for ocean freight, namely the #freight rate index and the annual TEU throughput increased to record highs.

* Seasonal patterns and COVID lockdowns led to less trade volumes and a recent softening of the index.

* #Maersk expects more than 70% of long-term contracts in 2022 out of all contracts, recently announced that could go up until almost 80%, an indication of significance for the guidance on world trade. This company earned $9Bn in the first quarter of 2022!

* Once China reopens following the lockdown (end of June or mid-July) huge amount of volumes will then have to be shipped out of China which are currently creating a backlog. That will not only increase the freights but push current congestion in Chinese ports to the west coast ports of the US and that shall possible take 4-6 months to normalise…

* The contracted #TCE is actually increasing, vessels that we have been able to fix for longer periods are the ones that have also already higher #charter #rates.

The pandemic has rocketed the #pet ownership around the world and provide further tailwind to this high growth market. Following are a few points that kept my attention in the 1Q 22 webcast of Pets at Home Group plc.

“…the first thing is we recognize that the pet is a member of the family. And we recognize often the pet is placed apparel alongside children in terms of the priority to the household. The spend on pet, is still relatively small income in the context of the overall family funding spend and is very, very #habitual. So anybody who is a pet owner will recognize you feed your pet, pretty much the same thing day in day out same quantity, often same brand, which is very habitual…

I was here in 2010, when we saw the last major financial crisis, a different side of shape and a makeup, and customers were under pressure. And we saw two things happen. We saw overall spend on pet on go up and interestingly enough, it was our fastest acceleration into advanced nutrition, which I think is also quite interesting in terms of often that can give you better value overall in terms of the quality of the food that you feed and you feed less food.”